In price action analysis, this is one of the most accurate bearish patterns. This decline came at a time when the pair was forming a rising wedge pattern. The GBP/USD pair made a bearish breakout on Friday even after the strong UK retail sales numbers. Therefore, as we have seen recently, investors will focus on the happenings in the banking sector. The economic calendar will be relatively muted on Monday, with no important data scheduled from the UK and the US.

Therefore, these numbers could push the BoE to intensify its hikes. UK’s consumer confidence is an important figure because of the crucial role of consumer spending plays in the economy. Data by Gfk showed that its consumer confidence index rose to -36, the highest level since March last year. UK consumer confidence also rose as inflation expectations dived. According to the Office of National Statistics (ONS), sales jumped by 1.25 on a month-on-month basis, higher than the analysts forecasts of 0.5%. The numbers showed that retail sales jumped in February as consumer confidence rose. The other important data that came out last week was the latest UK retail sales numbers. Analysts are penciling at least two more hikes this year. It also hinted that it will deliver more hikes even as the banking sector remains under pressure. The committee voted by 7-2 to increase interest rates by 0.25% to 4.25%. The closely-watched core inflation also continued rising.Īs a result, the Bank of England (BoE) continued with its rate hikes. These numbers showed that the headline consumer inflation resumed its upward trend in February as it rose to 10.4% after falling for three straight months. The GBP/USD pair rose to a multi-month high last week after the UK published strong consumer inflation data. The pair dropped to the psychological level of 1.2200, the lowest price since Tuesday last week. The GBP/USD price dropped slightly as an eventful quarter comes to a close and as UK’s inflation expectations dropped. Set a buy-stop at 1.2250 and a take-profit at 1.2350.Sell the GBP/USD pair and set a take-profit at 1.2070.We don’t advise you to trade based on a classical strategy, because you’ll experience difficulties with setting and subsequent execution of Limit order, namely: the price can trigger the Limit order and come back inside the range.ĭue to the really steep slope of the pattern’s side broken out, the price very rarely pulls back to it, but slight price move towards the side happens quite often.

You can experiment with it, but most of all, you must observe the rule of SL < TP. Sometimes it’s hard work setting Stop Loss according to this strategy, since the pattern occurs at the end of the trend.

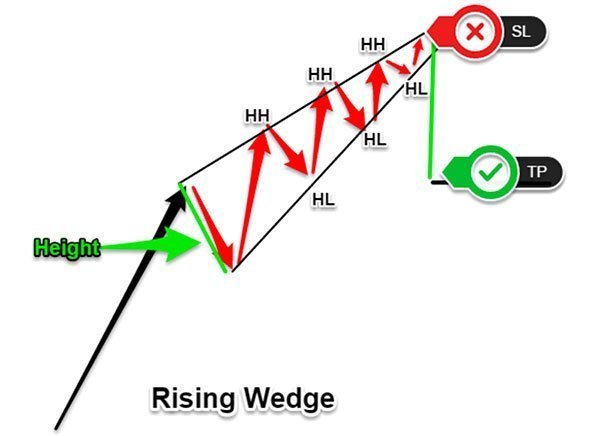

Stop order (Stop Loss, SL) is set outside the pattern’s border. Set a trading target (Take Profit, TP) at the level of one of the internal tops of the descending “Wedge” – they might be points (3, 4) *“Sweet zone” is the conditional name of the favorable range for the market entry that refers to the zone from the previous extreme to the pattern’s border (it is marked in green on the chart on the right side).Įnter the market (1) when the price is in the “sweet zone” (2) Strategy of market entry in the “sweet zone” *: “Wedge” is the pattern of average complexity within which the price makes abrupt moves followed by false breakouts due to constant making of new highs at that, the steeper the slope of the pattern, the harder it is to trade with the pattern successfully.Īlternative strategy of market entry and exit points. Alternative Strategies for the “Wedge” Pattern By the way, a snapshot of the order book (2) indicates that it is the last time when the price has made a new high. This may indicate adding to positions by a major player and preparation for the price reversal. In our case, the price constantly makes a new high on one side and comes back abruptly inside the pattern’s range – thus, the impulse in this direction is not of interest to us. Let’s clarify: as a rule, when the impulse is expected to make a new high, the price waits out while Stop Loss/Take Profit orders cluster on both sides of the pattern’s range. However, if conditions for clustering of orders are specially created for the “ Triangle”, these orders (1) are constantly triggered in case of the “Wedge”. The “Wedge” is often similar to a “Triangle” pattern having a horizontal flat side. The purpose of these manipulations is simple – knocking extra “passengers” out of the market or adding to positions by a large participant. Reasons for the “Wedge” Pattern Formationīeing a reversal pattern, the “Wedge” pattern implies manipulations during its completion.

0 kommentar(er)

0 kommentar(er)