Cumulative purchases cannot exceed the maximum cycle limit of $20,000. This maximum includes charges for tax, freight, and handling. The purchase exceeds the allowed amount: A purchase cannot exceed the maximum single purchase limit of $4,999 maximum transaction amount. Once the decline reason is provided, contact the Procurement Card team to troubleshoot specific issues such as limits and opening vendor codes. Bank at (800) 344-5696 and request the decline reason. USBank utilizes specific mechanisms that trigger a decline on Procurement Cards to protect the cardholder, the merchant, and UCSD. Written procedures on all cashiering and cash control procedures are maintained by each agency.ĭES provides automated invoicing using the Agency Billing System (ABS) in Agency Financial Reporting System (AFRS).ĭES manages aged outstanding receivables.Your Procurement Card purchase might be declined at the point of sale even if a merchant accepts the Procurement Card (Visa card).Cashiers are prohibited from cashing personal checks or notes of personal indebtedness.Cash receipts retained on the premises overnight are minimized and locked up in a secure place, such as a safe.However, deposits are not to be delayed because the account distribution cannot be immediately determined.

Suspense accounting is eliminated whenever possible by the direct deposit of the item to the correct fund and account.

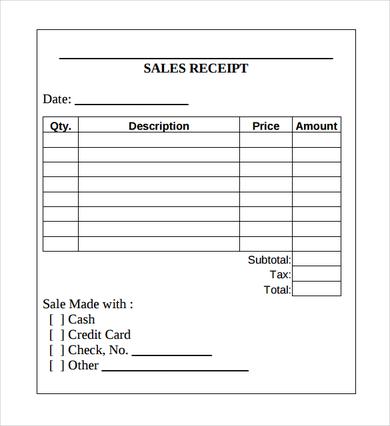

Collections made over the counter or in the field are documented by the issuance of sequentially pre-numbered official receipts or through cash registers or automated cashiering systems.Cash is protected by the use of registers, safes, or locks, and kept in areas of limited access.The secured area is locked when not occupied. Access to the secured area is restricted to authorized personnel only. A secure area is needed for the safeguarding and processing of cash received.Documents enclosed with the currency received are machine date stamped or dated and initialed by the employee opening the mail. Amounts of currency contained in each item of mail are verified.A weekly comparison of the cash list and Cash Receipt Report received via email should be completed. A second copy of the cash list is used for accounting controls. A copy of the cash list is then forwarded to the DES Finance Cashier with receipts. One person needs to create a cash list another person should review the cash list with the receipts. Two persons should open the mail when they expect cash or checks in the mail.Incoming cash must be made a matter of record as soon as possible.Specifically, no one individual’s duties should include the actual handling of money, recording receipt of money, and the reconciliation of bank accounts or with the state treasurer. No individual is to have complete control in the handling of cash. Segregation of duties in the handling of cash is one of the most effective ways to gain control over this asset.This resource intends to aid an agency in understanding its risks and identifying applicable controls to minimize those risks. The proper control of cash receipts is the responsibility of the agency director.

0 kommentar(er)

0 kommentar(er)